Why Don't We Recommend 529 Plans for Saving for Kids’ Education?

Co-Authored and Reviewed by Gagan Sandhu, MBA - The University of Chicago Booth School of Business, CEO of Xillion

Posted on . 4 min read

When it comes to saving for your child's education, the 529 Savings Plan often comes up as a go-to option. Widely known for its tax benefits, including deductions from state taxes or tax-free withdrawals, it's no wonder why it is a popular choice. Despite its popularity, here's a detailed look at why the 529 Plan might not be the best option and how a Post Tax Brokerage account is better.

1. Limited Investment Options

The 529 Plans often come with a constrained set of investment options. Unlike a brokerage account, where you have the freedom to choose from a broad array of stocks, bonds, or mutual funds, 529 Plans restrict your ability to tailor your investment strategy to meet specific goals or risk tolerance. This limitation may hinder your ability to achieve decent returns.

2. No Flexibility with the Use of Funds

The funds in a 529 Plan are strictly earmarked for qualified educational expenses. This lack of flexibility can be problematic if your child decides not to attend college or use the money to fund his or her business. In such cases, withdrawing the money for non-educational expenses results in taxes and penalties. Conversely, Post Tax Brokerage accounts have no such restrictions, clearly making them a more flexible option.

3. High-Cost Funds, Hence Lower Returns

Another drawback of 529 Plans is that they often include high-cost funds. The expenses related to managing these funds can significantly eat into your returns, especially over the long term. Even though they offer tax benefits, these may not offset the loss in returns due to higher costs. Post Tax Brokerage accounts generally come with lower fees, leading to better overall returns without the need for specific tax advantages.

A typical 529 Savings Plan fund has an expense ratio ranging from 1% to 0.5%, which is over 10 times higher than that of a typical S&P 500 Index Fund.

4. Time Investment

Time Investment in 529 Plans can be substantial due to their complexity and variation between states. Managing rollovers, tax deductions, and potential penalties requires navigating complicated rules which differ from state to state. You either invest significant time in understanding these complexities or hire a financial advisor, often at a 1% charge. Both options can add to the overall burden and cost of the investment, making 529 Plans a less appealing option for most.

5. The Opportunity Cost of Money Locked for a Long Time

Money invested in a 529 Plan is locked until it is used for qualified education expenses. While this helps ensure that the funds are used for their intended goal, it also means that the money is not available for appealing investment opportunities or emergencies. This opportunity cost may lead some to consider alternatives that allow for greater flexibility and the potential for higher returns in other areas.

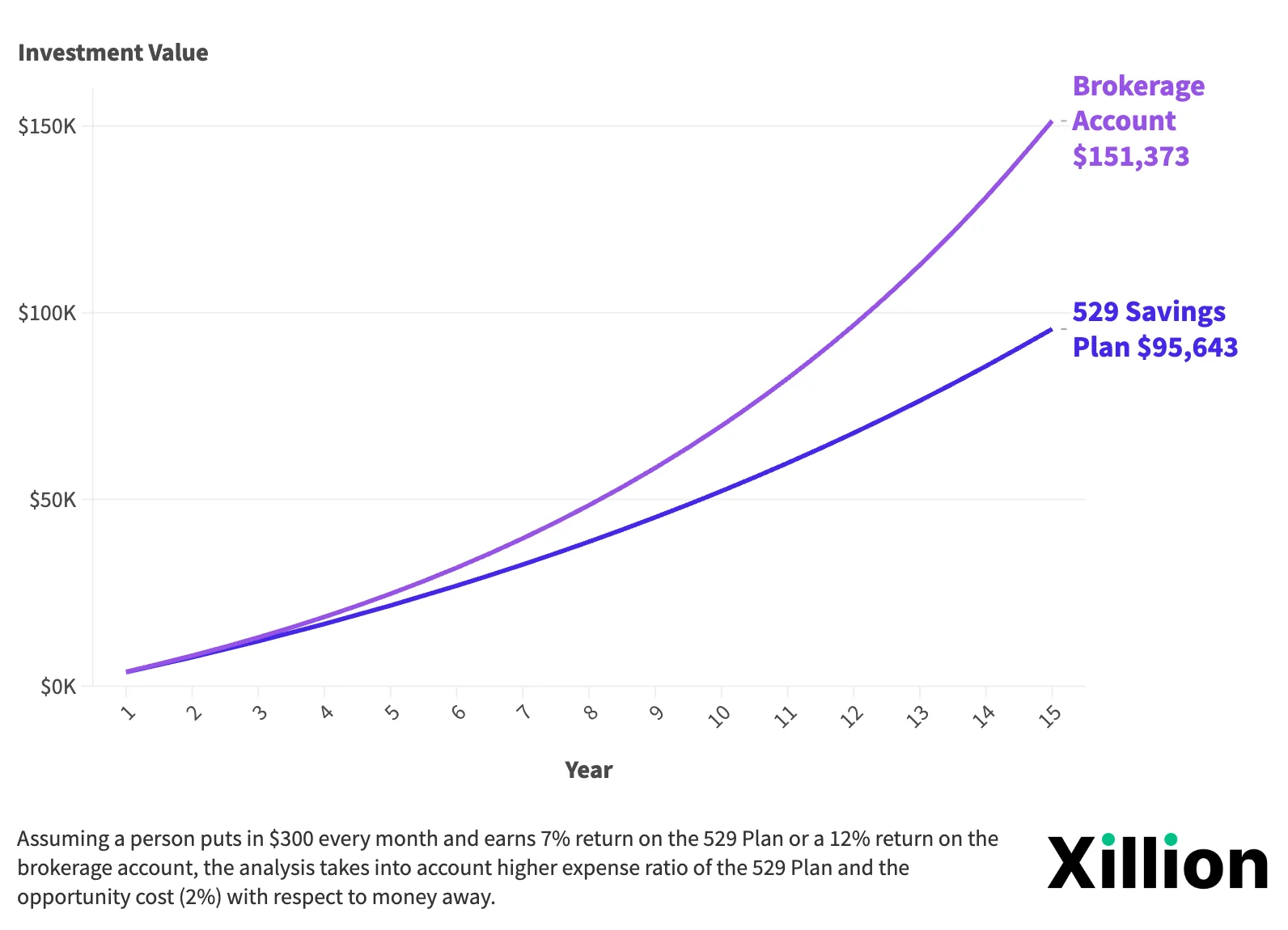

Even after paying a 15% capital gains tax of $14,606, you'll be left with $136,767, which is $22,394 more than what you would otherwise have with a 529 Savings plan.

Additionally, don't be misled by the term 'Index' in the names of some 529 Plans, such as 'NH Portfolio 2030 (Fidelity Index).' Though it might appear that you're investing in an index fund, the reality is different. In fact, 'NH Portfolio 2030 (Fidelity Index)' is a blend, comprising a U.S. Total Market Index fund, a Non-U.S. Index Fund, and 52% allocated towards debt. This composition has led to its performance being only half that of the Fidelity 500 Index Fund. These are not just theoretical concerns but actual facts that underline the importance of carefully examining the specifics of any fund labeled as an 'index' within a 529 Plan to ensure it meets your investment objectives.

529 Index option only returned an annual average return of 6.61% over 10 year period while the Fidelity 500 Index Fund returned 12.65%, more than double the 529 Plan.

It's worth noting that some 529 managers do offer an S&P 500 or a U.S. Total Stock Market Index Fund. If you are living in a state that offers such an option, it could be a great choice. However, keep in mind that the money invested in a 529 Plan is locked away and can't be used for other investment opportunities in the future. Moreover, it doesn't save you from the time investment that goes into researching and managing your 529 Plan. So, take the time to work out your finances and see what makes the most sense for your individual situation.”

Conclusion

Post Tax Brokerage accounts are not just an alternative but a more adaptable and profitable option for saving for your child's education. The decision is clear: for those seeking investment freedom, flexibility in fund usage, and potential for better returns, Post Tax Brokerage accounts are the better choice. This is not just a possibility; it's a financially sound decision that aligns with the needs of modern families planning for their children's future.