Investing with Confidence

Co-Authored and Reviewed by Gagan Sandhu, MBA - The University of Chicago Booth School of Business, CEO of Xillion

Posted on . 4 min read

Xillion’s Money Allocation Tool helps you make smart and informed investment decisions for long term financial success.

Investments Decisions Are Were Hard

Should I invest in stocks? Or real estate? Maybe gold? How would my investments grow in the future?

We all struggle with these questions because there are so many (mostly bad) opinions out there telling you what to do with our money. If you talk to a realtor they will tell you real estate investing is where the real money is. And your banker cousin might tell you that bonds are the only way to safeguard your future. Who’s telling the truth?

We at Xillion got really fed up with all this bogus advice so we channeled our frustration into building a nifty tool that lets you decide how to invest across different types of investments.

We Built A Tool To Help You Make Investments Decisions With Confidence

Xillion’s Money Allocation Tool (MAT) helps you decide how much money to put in each type of investment to reach your goals. MAT lets you define your risk and your preferred investment style and gives you a pretty accurate picture of how your investments will grow over the next 10 years. Our goal is to help you become financially independent in 10 years and this is a step in that direction.

How does it work? Drag each investment type left or right to increase or decrease it. Keep an eye on the total amount at the end of 10 years to get an idea of how changes in what you invest in compounds over time. Also pay attention to your overall rate of return after 10 years as you change the mix of investments. You can also change the total amount to match your current net worth to get an accurate picture.

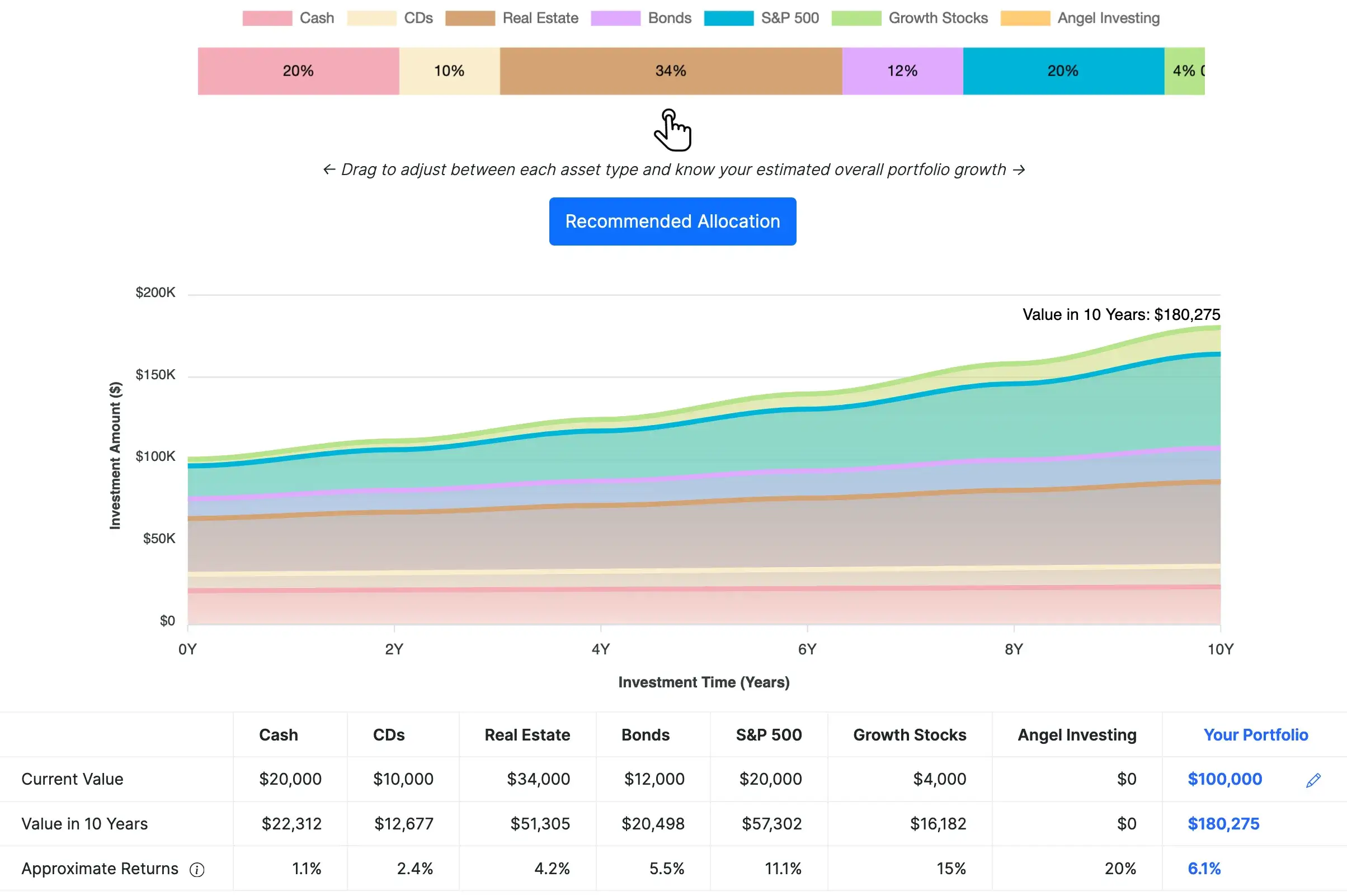

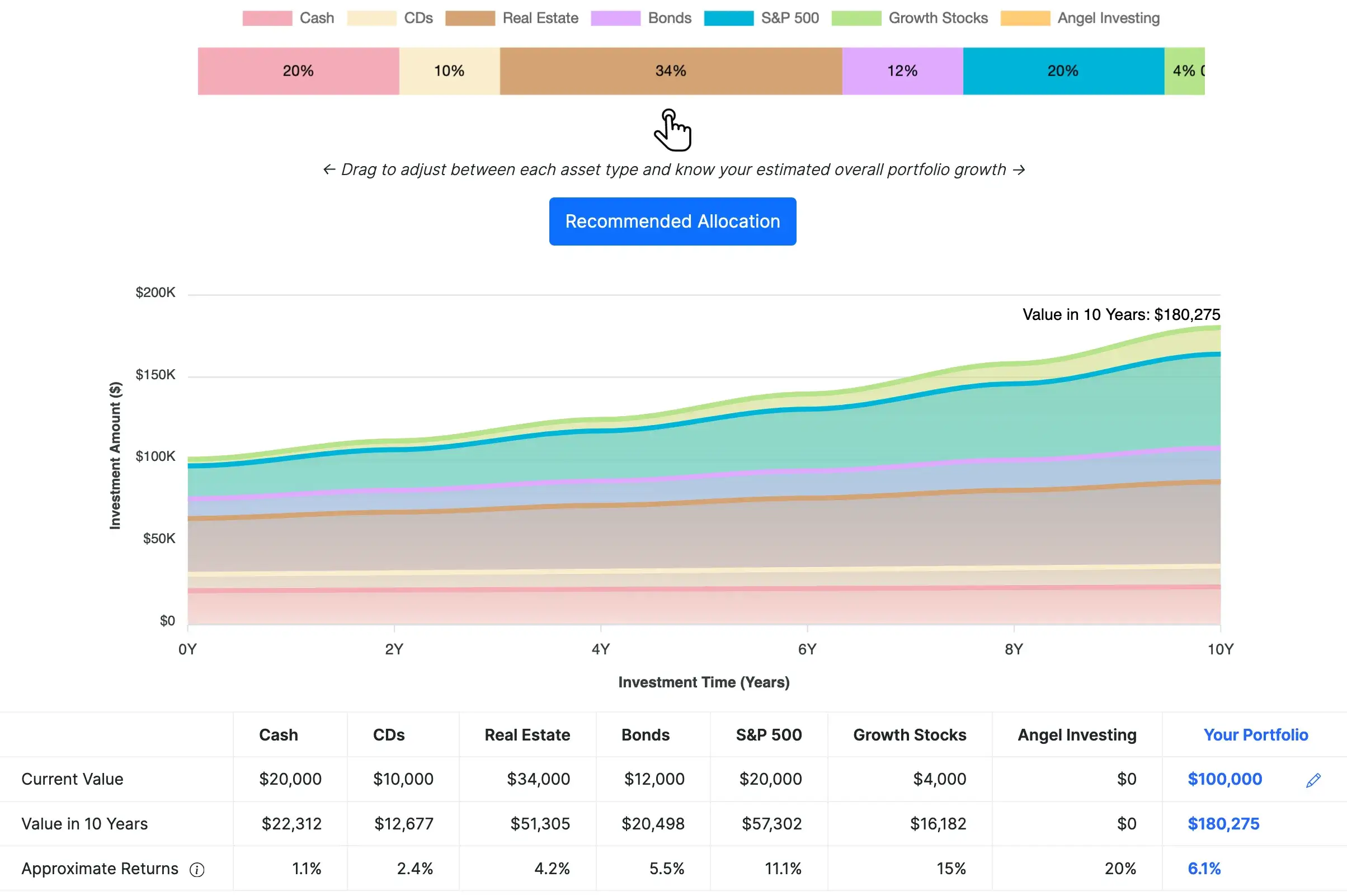

Example 1: Investment Mix of a Typical Millennial in the US

A typical millennial in the US has 34% of their investments in real estate and around the same amount in index/bond funds as well as cash but only a small amount in growth stocks. $100,000 invested this way is likely to grow at the rate of 6.1% annually to $180,275 in 10 years.

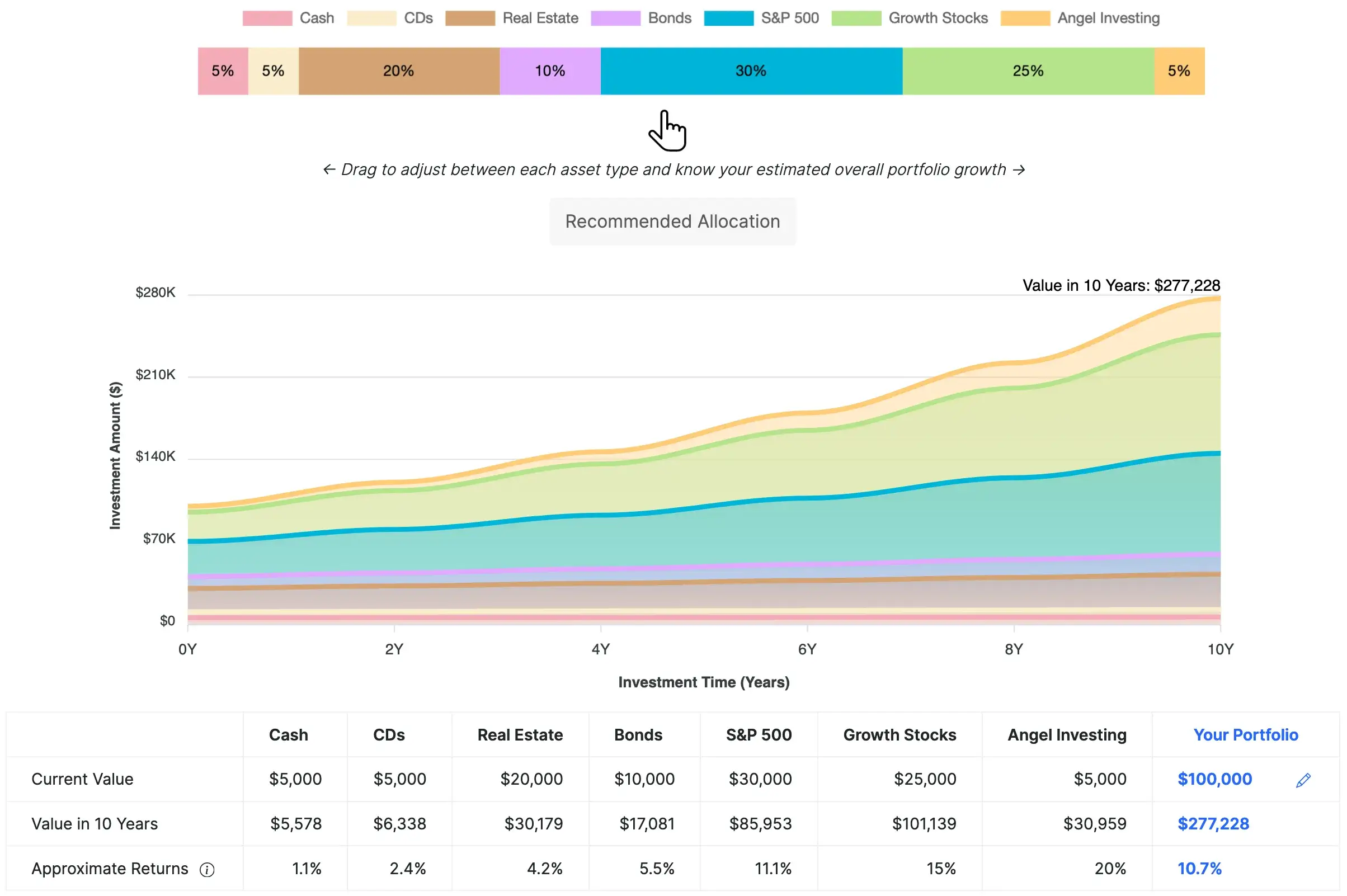

Example 2: Xillion Recommended Investment Mix

$100,000 invested this way will grow at the rate of 10.7% annually to $277,228 in 10 years, almost $100,000 (54%) more than the typical allocation. Imagine all the ways you can improve your and your loved ones lives with an extra $100,000.

What are you waiting for? Say hi to MAT! And make investment decisions with the confidence of a Wall Street banker (because they rely on the same information to make decisions).

Note: Returns in MAT are based on long term investment returns for each type of investment. Short term returns can vary a lot but long term trends hold really well.

Appendix:

Source: US Federal Reserve

Returns on Common Assets:

Cash: 1.1%

Over the last decade and a half, interest rates for savings accounts have remained really low, averaging around 1.1%.

Source: Bankrate Article , Chart , FDIC Savings Rates

CDs: 2.4%

Certificates of Deposit (CD) & treasury rates have also stayed low for almost two decades until now.

Source: FDIC Savings Rates , 10-Yr Treasury Rates

Real Estate: 4.2%

Real estate returns have averaged around 4.2% per year over the past 30 years.

Source: NYU Prof Aswath Damodaran’s Website

Bonds: 5.5%

Bonds have historically returned around 5.5% per year over the past 45 years.

Source: Visual Capitalist Article

S&P 500: 11.1%

S&P 500 index fund has returned around 11.1% per year over the past 30 years.

Source: NYU Prof Aswath Damodaran’s Website

Growth Stocks: 15%

US growth stocks have returned an average of 15%-17% per year over the past 50 years.

Source: Growth vs Value Stock Performance

Angel Investing: 20%

Venture capital returns are more than 20% as measured by Refinitv since 2012.

Source: Refinitiv Venture Capital Index

Your Portfolio: ??%

Based on what mix you choose between real estate, bonds, stocks etc., your portfolio’s total return rate will be approximately what is mentioned in this column.

Note: The returns mentioned here are not adjusted for inflation.